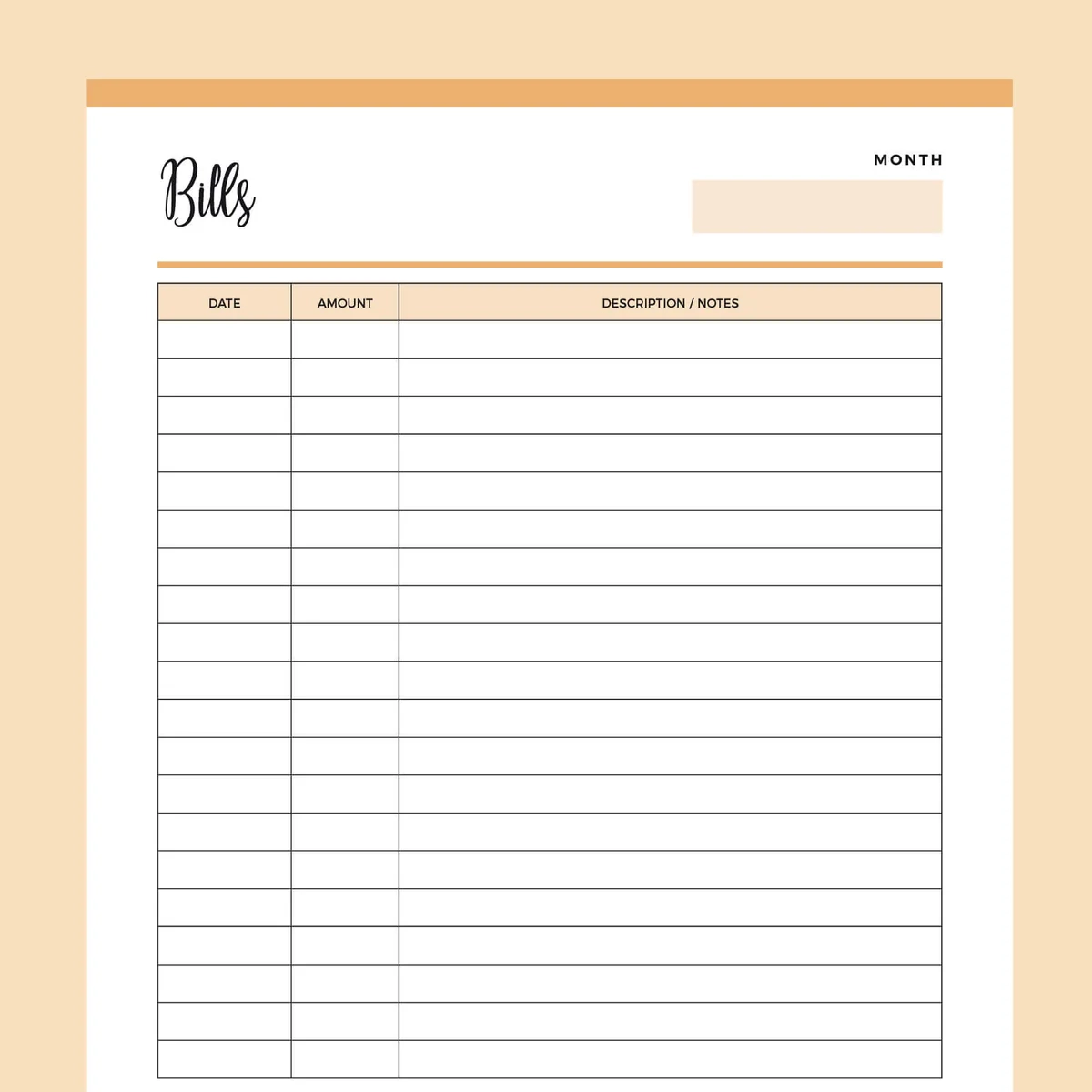

If you’re looking for an easy way to keep track of your payments, a printable payment record sheet could be just what you need. This simple tool can help you stay organized and ensure you never miss a payment deadline.

Whether you’re managing your personal finances or running a small business, having a clear record of your payments is essential. By using a printable payment record sheet, you can easily track your income and expenses, monitor due dates, and avoid late fees.

Printable Payment Record Sheet

Printable Payment Record Sheet: Stay on Top of Your Finances

One of the key benefits of using a printable payment record sheet is that it allows you to see your financial situation at a glance. You can quickly see how much you’ve paid, how much you owe, and when payments are due. This can help you plan your budget more effectively and avoid any surprises.

Another advantage of using a printable payment record sheet is that it can help you identify any discrepancies or errors in your payments. By keeping a detailed record of all your transactions, you can easily spot any mistakes and take action to correct them.

Using a printable payment record sheet is also a great way to stay organized and reduce stress. Instead of scrambling to find important payment information when the due date approaches, you can simply refer to your record sheet and know exactly what needs to be done.

In conclusion, a printable payment record sheet is a simple yet powerful tool that can help you stay on top of your finances. By using this tool to track your payments, you can avoid late fees, identify errors, and reduce stress. So why not give it a try and see the difference it can make in your financial life?

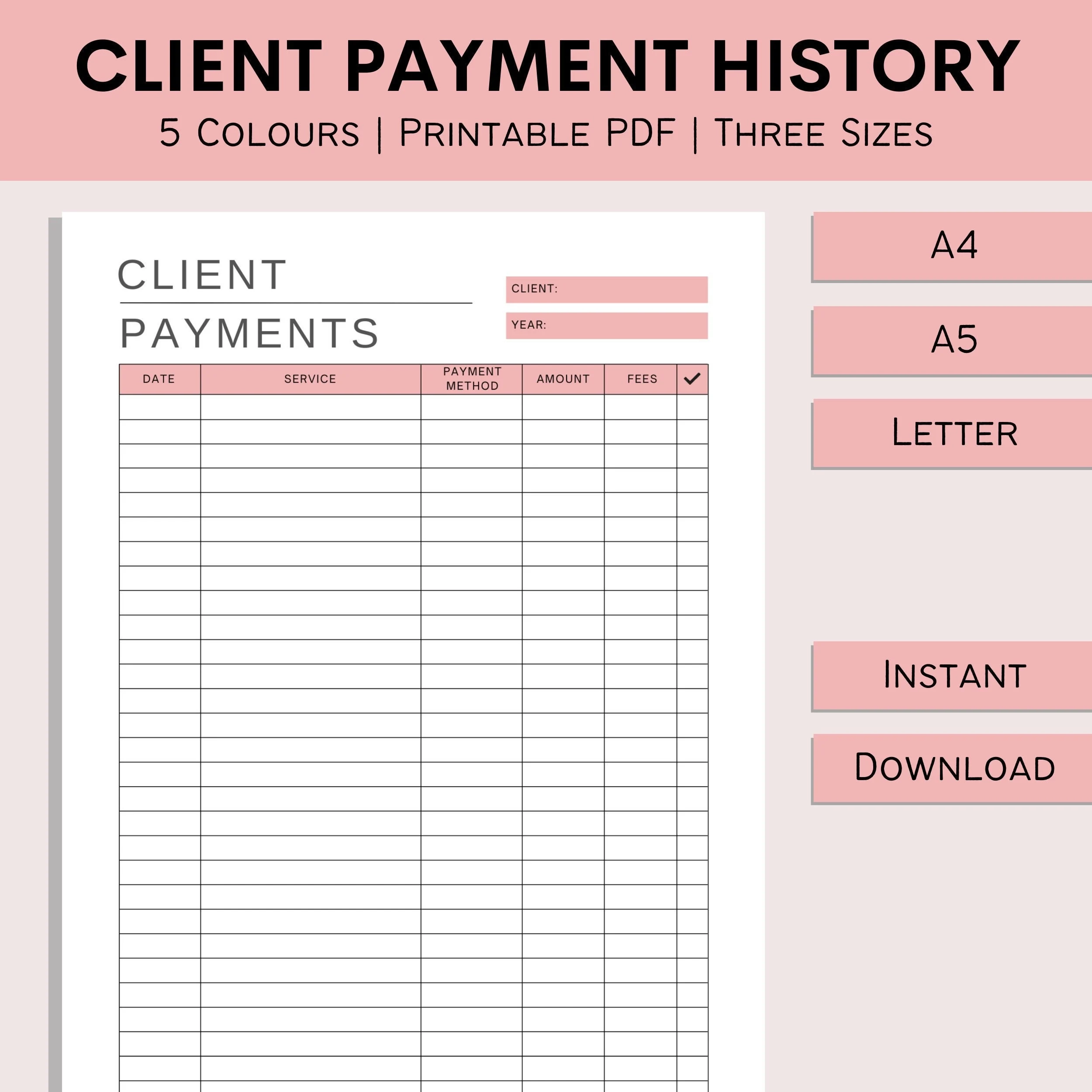

Client Payment History Printable Client Log Small Business Finance Sheet Payment Form Service History PDF A4 A5 Letter Etsy

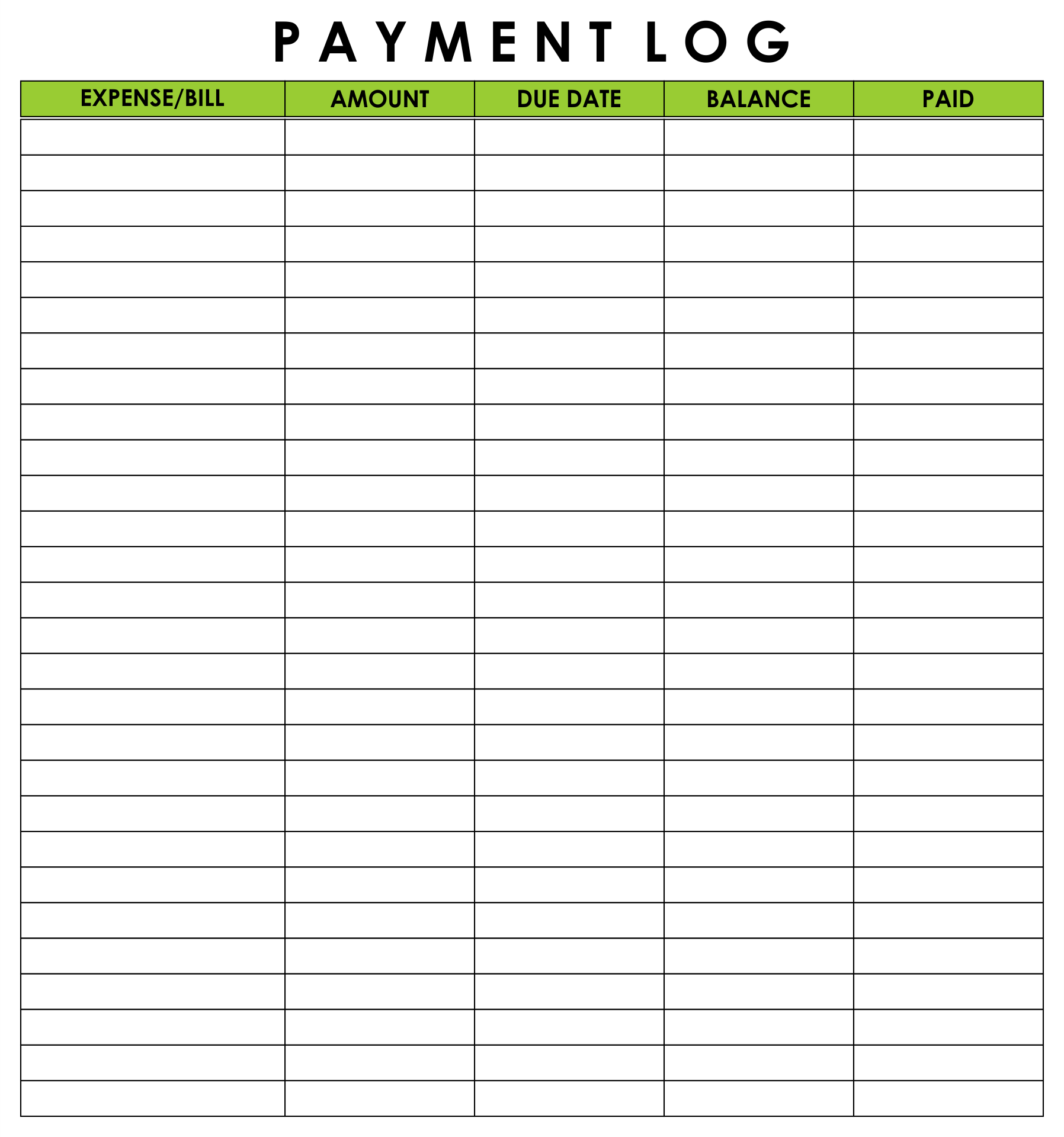

Payment Log Sheet Template 10 Free PDF Printables Printablee