Are you a small business owner looking for a simple way to report your income and expenses? The IRS Schedule C-EZ form might be just what you need. This form is designed for sole proprietors and freelancers who have a straightforward business.

Filing your taxes can be overwhelming, but the IRS Schedule C-EZ form makes it easier for small business owners. With this form, you can report your business income and deductions without the complexity of a full Schedule C.

Irs Schedule C-Ez 2026 Printable

Irs Schedule C-Ez 2026 Printable

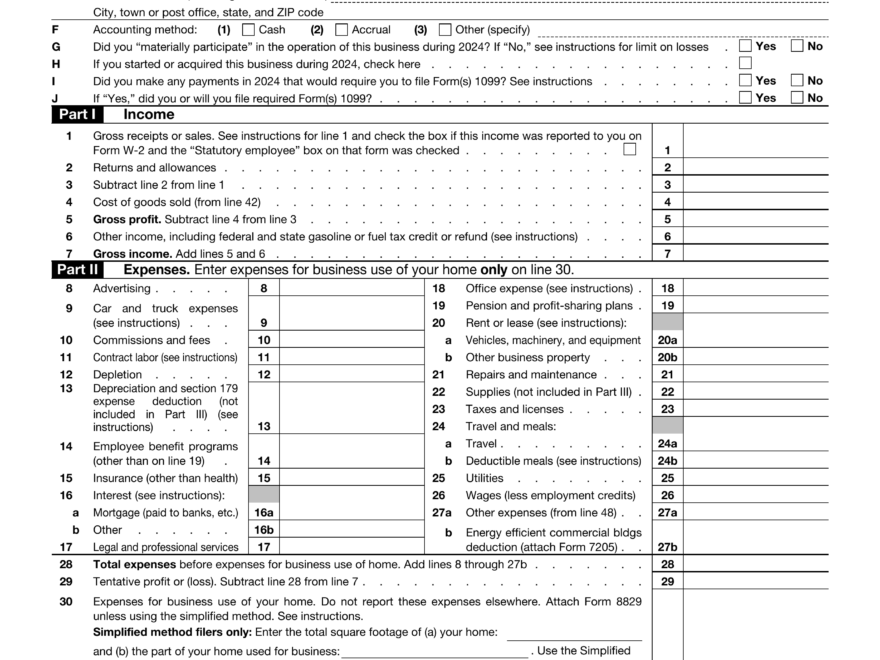

The IRS Schedule C-EZ form is a simplified version of the Schedule C form, making it easier for small business owners to report their income and deductions. This form is designed for sole proprietors and freelancers with a simple business structure.

To qualify to use the Schedule C-EZ form, your business must meet certain criteria, such as having expenses of $5,000 or less, no employees, no inventory, and no depreciation of property. If your business meets these requirements, you can use the Schedule C-EZ form to report your income and deductions.

When filling out the Schedule C-EZ form, make sure to accurately report your income and expenses. Keep thorough records of your business transactions throughout the year to ensure that you have all the necessary information for tax filing. Remember to consult with a tax professional if you have any questions or need assistance with your taxes.

In conclusion, the IRS Schedule C-EZ form is a convenient option for small business owners who have a simple business structure and want to streamline their tax filing process. By using this form, you can accurately report your income and deductions without the complexity of a full Schedule C. Stay organized, keep detailed records, and consult with a tax professional for guidance to ensure a smooth tax filing experience.

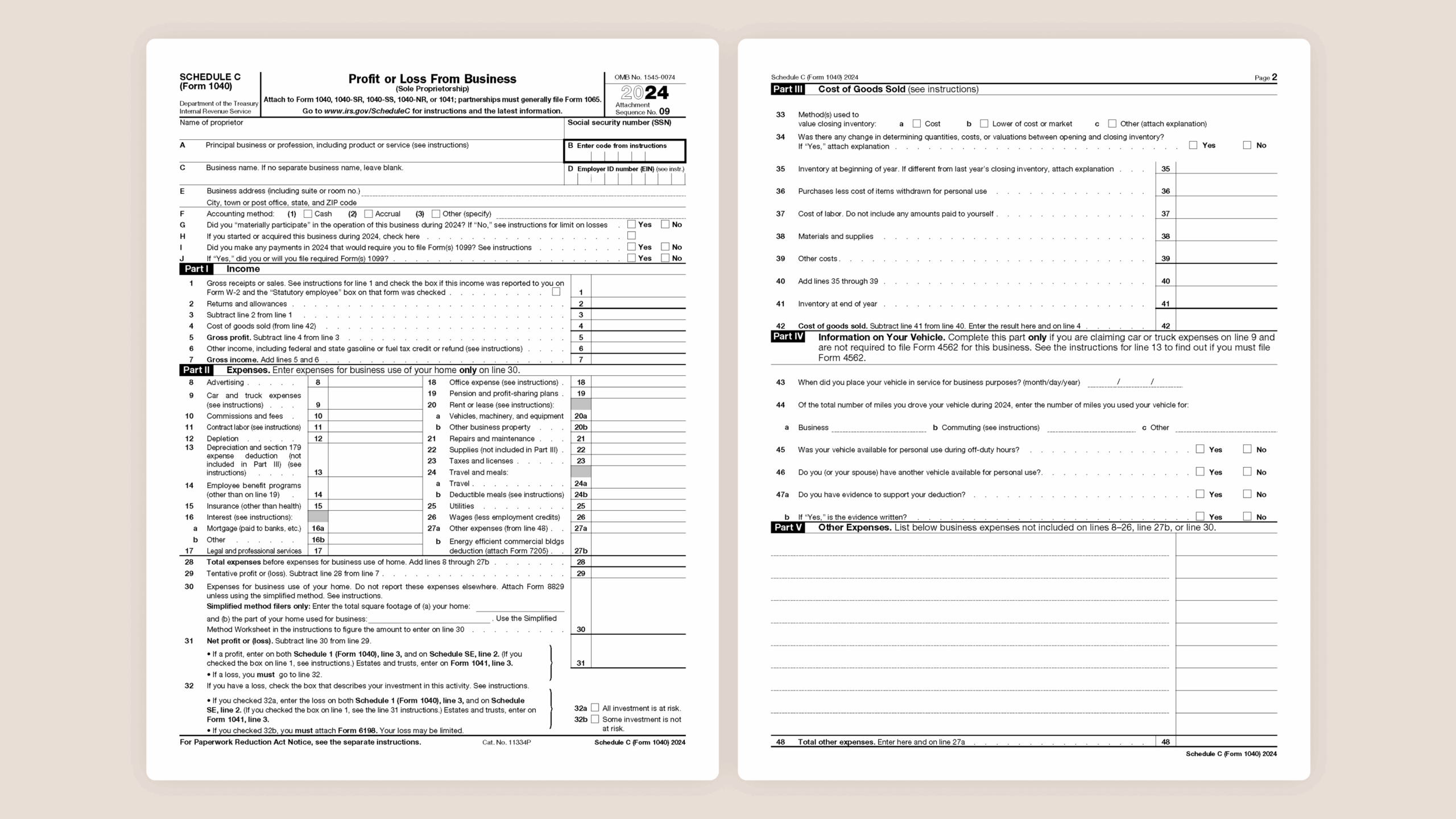

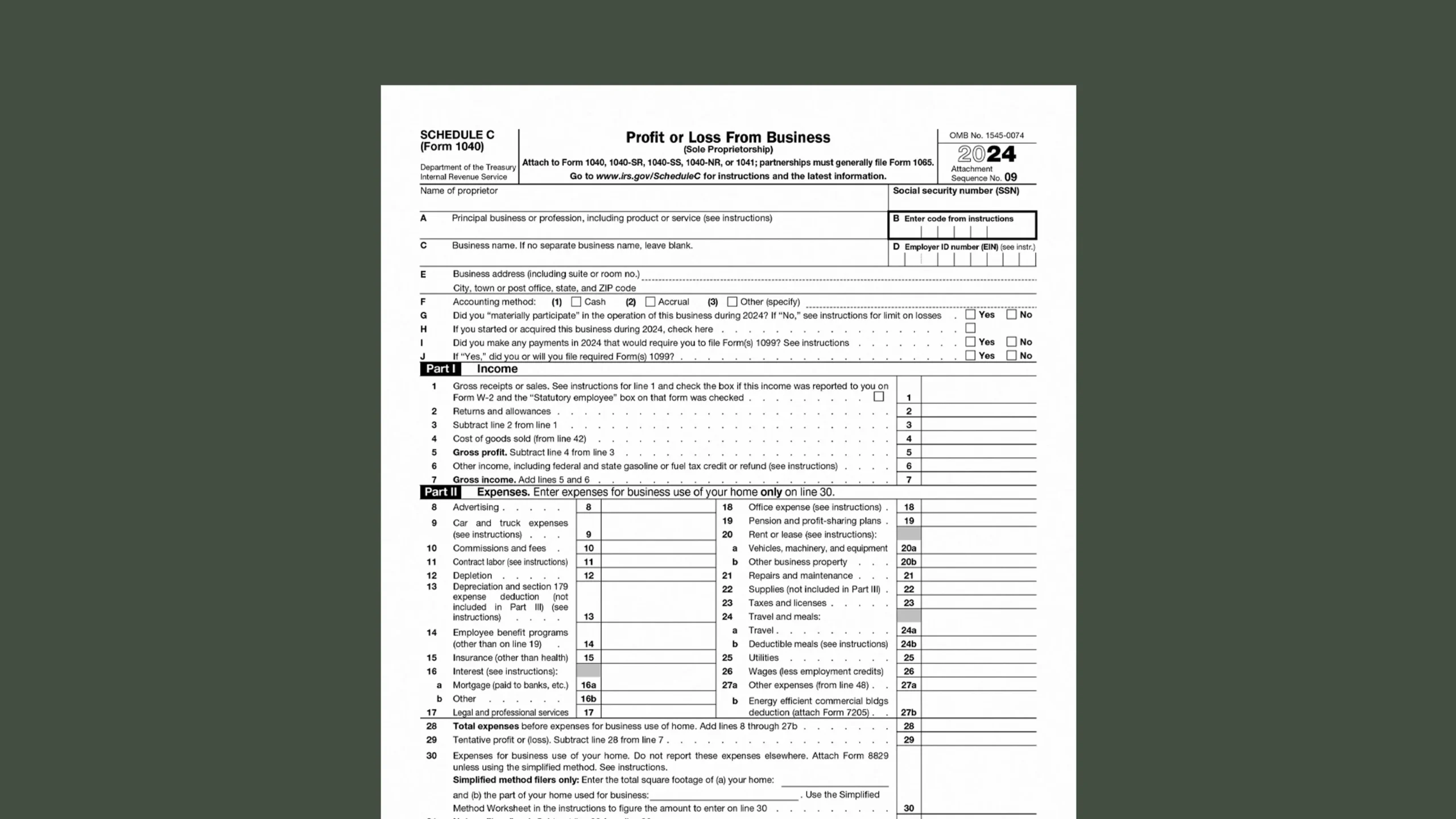

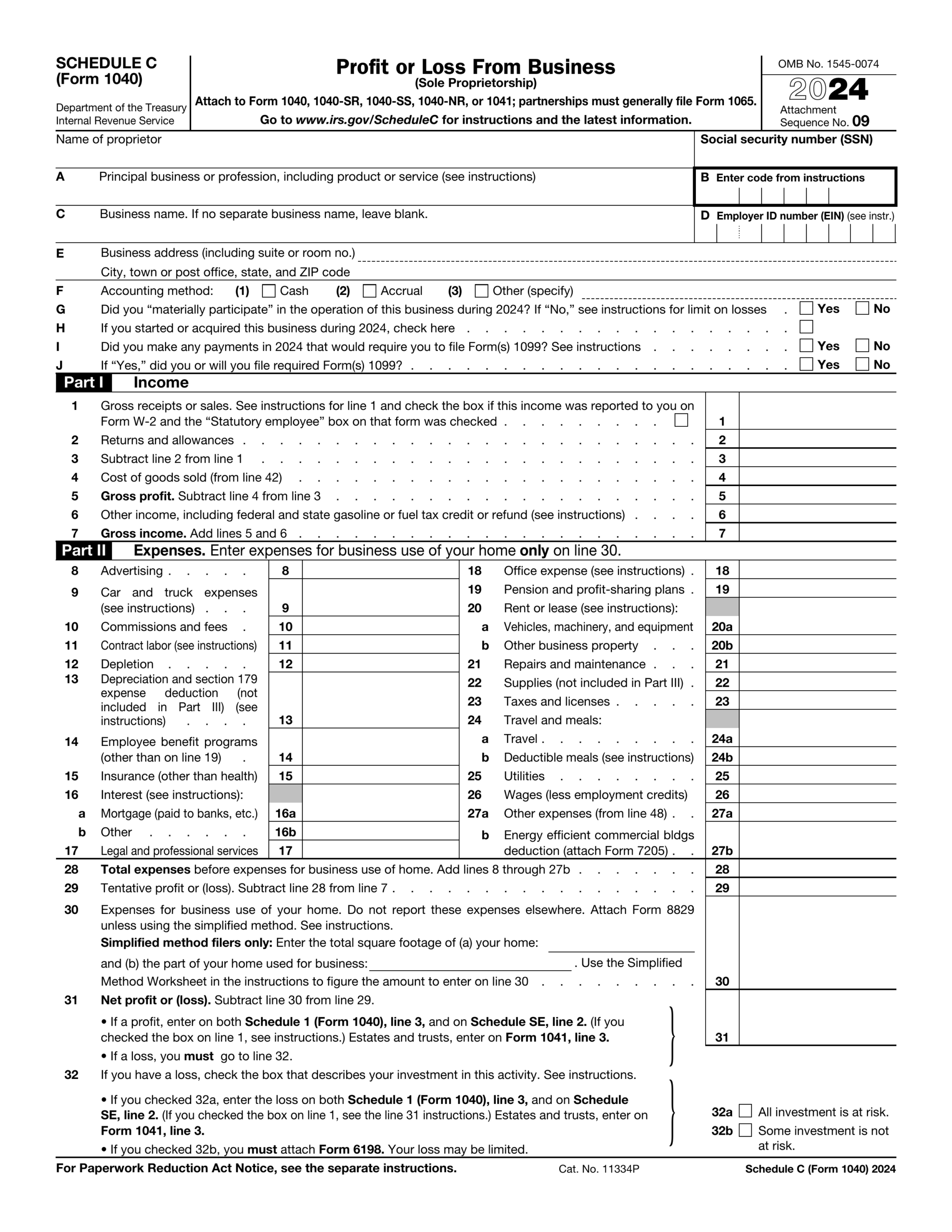

A Step by Step Guide To Filing Schedule C Form 1040 Ambrook

1040 Schedule C 2024 2025 Fill And Edit Online PDF Guru